greyapalon

Does Full Coverage Car Insurance Cover Other Drivers

.jpg)

Hey, Can I Borrow Your Car. Car owner’s insurance to cover any accidental damage, so if they’re not insured or don’t have the right coverage, as the driver. Your car insurance would be. Jeevan Ek Sanghursh Hai Film Song Download. Your auto liability coverage may help pay for the other driver's. If your insurance company will cover your.

Read the Spanish version: If you drive your car and cause an accident, your will pay for the damages you cause, as defined in your policy. If your friend drives and crashes your car, you may assume that he -- and his car insurance -- will pay for damages. In fact, you are on the hook.

Here are a number of accident scenarios and what you can expect to happen. 1: Your friend drives your car and causes an accident with minimal damage to your car only. If you loan your car to a friend, he damages your car and both of you have car insurance, normally your insurance will pay, under, and you'll have to pay your deductible. Most auto insurance policy insures your vehicle plus you, any relative or anyone else who uses your car, if the use reasonably is believed to be with your consent. Insurers refer to people you allow to operate your car as permissive drivers. 2: Your insured friend drives your car and causes an accident with a lot of damage. Let's say the accident your friend causes results in serious bodily injury to others and property damage.

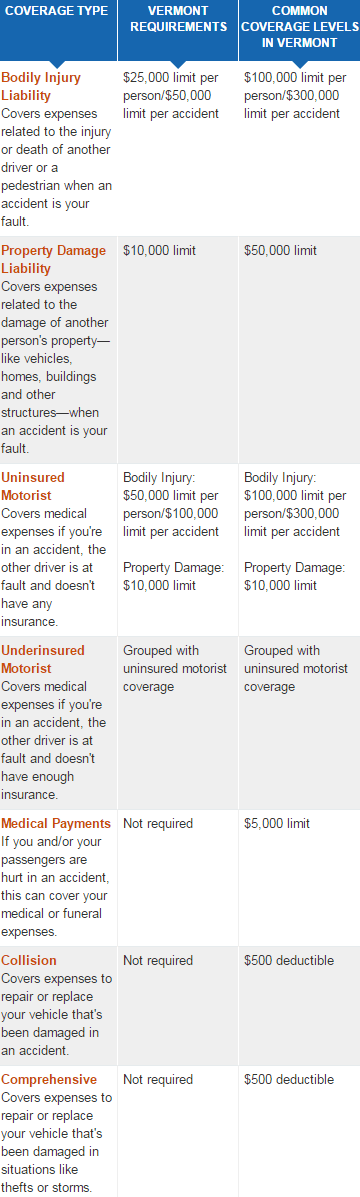

Liability coverage consists of two parts: bodily injury liability and physical damage liability. Liability insurance follows a car first and driver second. That means the car owner's policy covers the driver and all passengers in the other vehicle for bodily injury. The car owner's liability also covers property damage caused by his or her car. Also covers the cost of your legal fees in the event that you are sued. But if the damage exceeds your insurance liability limits, the courts can attach your personal assets, such as your home, to recover damages. Liability coverage won't pay for damages beyond the limit for which you are insured.

If your liability limits are not enough to cover all the damages inflected on the other party, your friend's auto policy may be looked at secondary coverage. Cases in which you and your friend's insurance policies share the cost of the accident are known as 'pro rata.' For example, say your friend causes $22,000 in property damage while driving your car. You have $10,000 in property damage coverage and your friend has $25,000; total coverage available is $35,000. Typically, in pro-rata cases, your insurance would pay the up to your limits, $10,000 and then have the other party look to your friend's insurer for the remaining $12,000. However, some insurers will pay the entire amount of damages and then seek compensation from your friend's insurer to recover the amount not covered by your policy. If your friend was injured and has on his auto policy personal injury protection (PIP), he would claim against his policy for this.

PIP is different and follows a driver first and car second, meaning if he didn't have PIP and you did, then he could claim against your PIP coverage. Red Alert 3 Free Download Full Game For Windows 7 32bit. 3: Your uninsured friend drives your car and causes a lot of damage. Lending your car to an uninsured friend can land you in a world of hurt. In this case, your uninsured friend has put you in a really bad spot. If the damage your friend causes exceeds your policy limits, the injured party can come after you for medical and property-damage expenses. 4: Your unlicensed friend drives and crashes your car.

Letting a friend that doesn't have a valid license, either without one altogether or under suspension, is a bad idea. Many car insurance policies include an exclusion of coverage if the driver of your vehicle doesn't have a valid license. And if he doesn't have a license, it's doubtful he'd have auto insurance. This would leave you and your friend responsible for any damages he caused in an accident. You can say it wasn't you driving, but car owners have vicarious liability for anyone they allow to use their vehicle.

Comments are closed.